Once again, we would like to say a big thank you to everyone who responded to our recent Home Energy Survey. Almost 700 peoples got in touch to tell us about their home energy bills, and how they have changed over the past year.

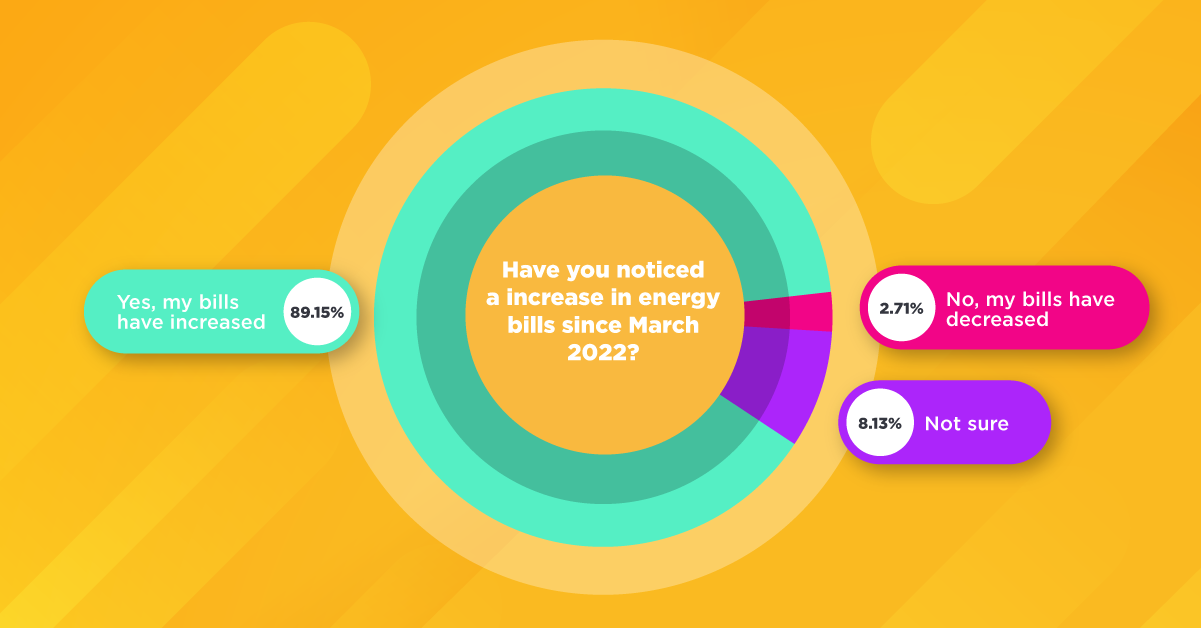

What we’ve found from these findings is that while personal circumstances seem to be improving, the numerical cost of energy bills certainly is not. In fact, energy bills have risen, once again, after two consecutive years of near constant price hikes.

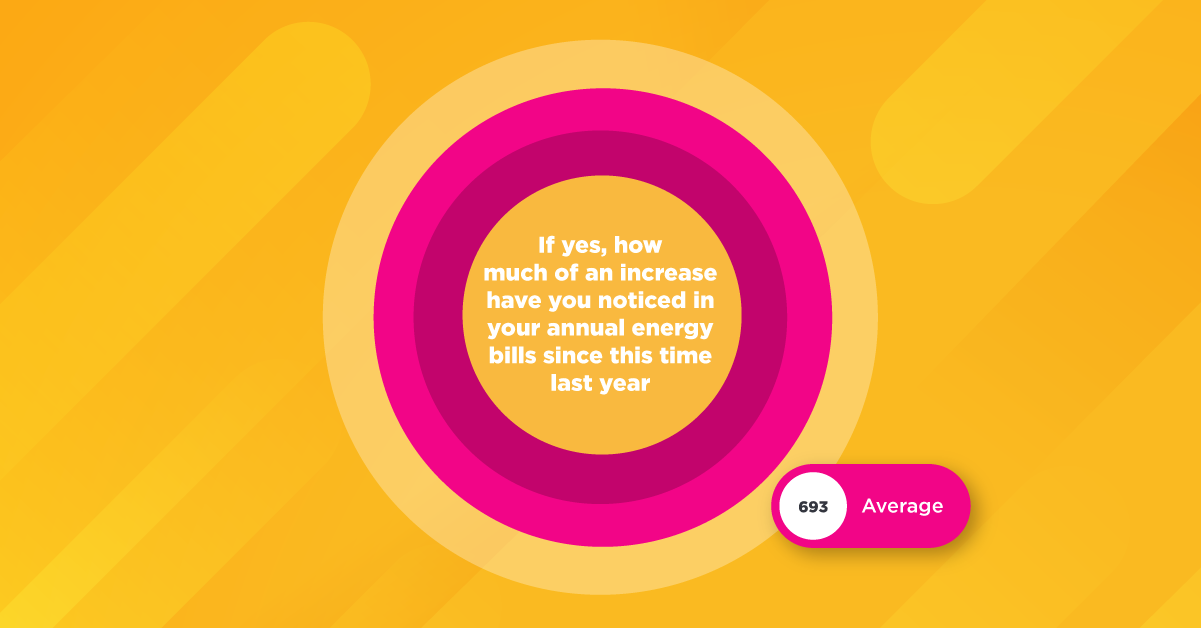

We have found that the average energy cost increase between 2022 and 2023 was higher than that between 2021 and 2022.

In the past year, on average, people have seen their annual bill increase by £693. The cost increase in the previous period was already high at £404.

How have people coped with these prices?

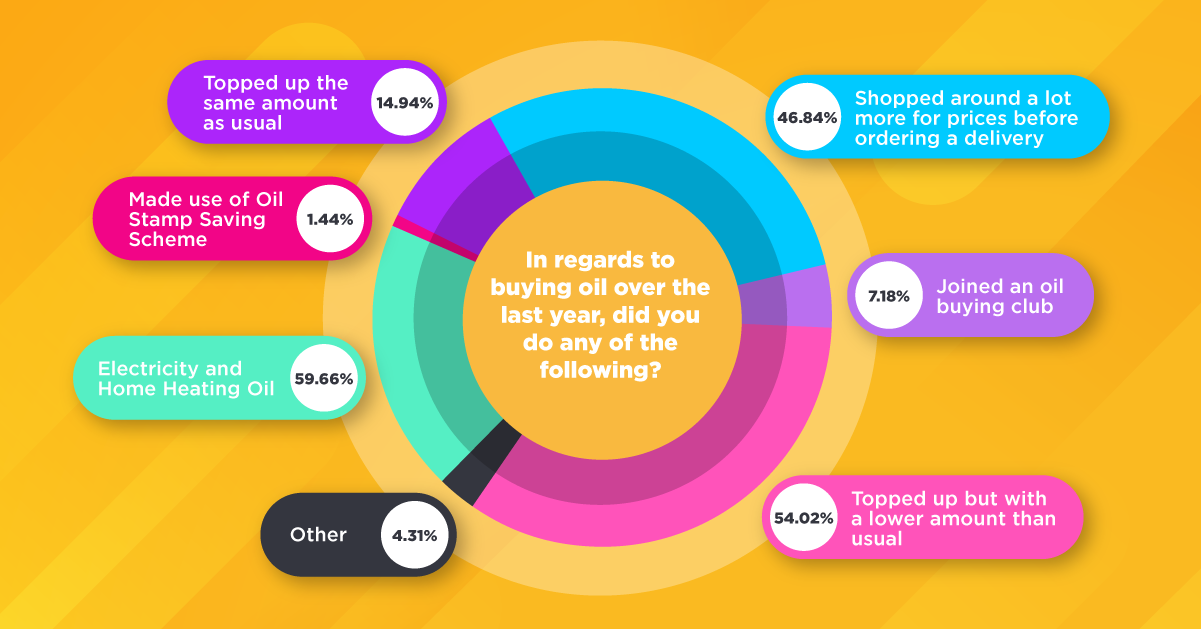

When buying oil—54% of respondents topped up with a lower amount than usual and 31% went without topping up entirely. Only 14% topped up the same amount.

The good news in this survey, however, is that while prices are still higher on average, households appear to be adapting to the different financial circumstances, or being better supported by government and charitable organisations.

For instance:

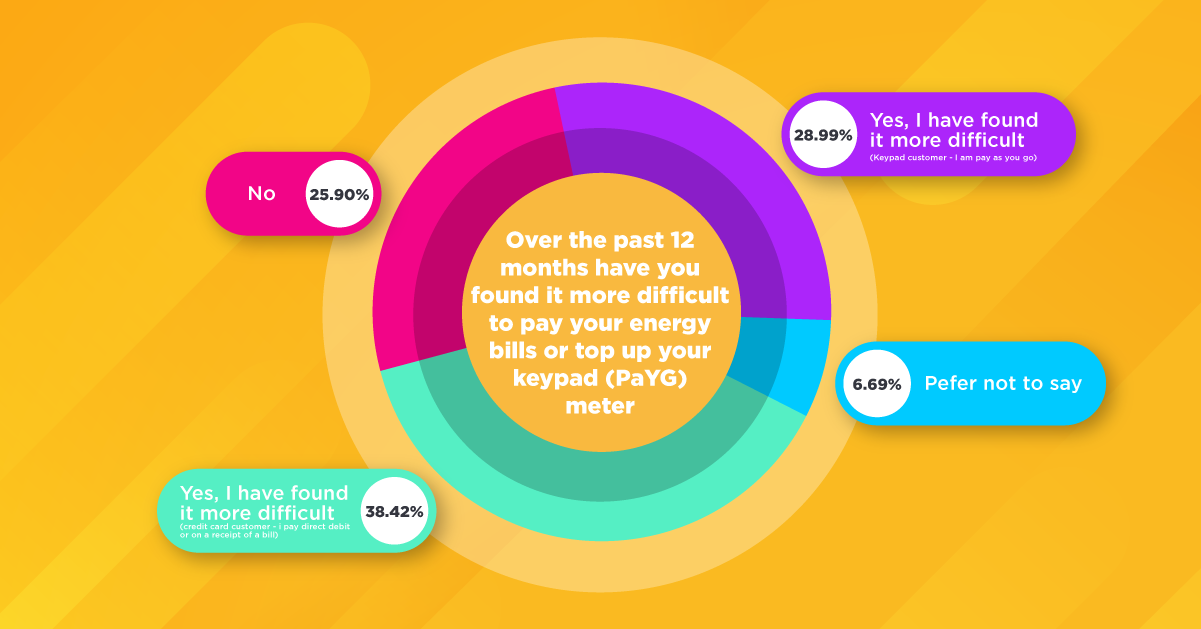

- 64% of keypad respondents found it more difficult to top up this year, compared to 67% from 2022

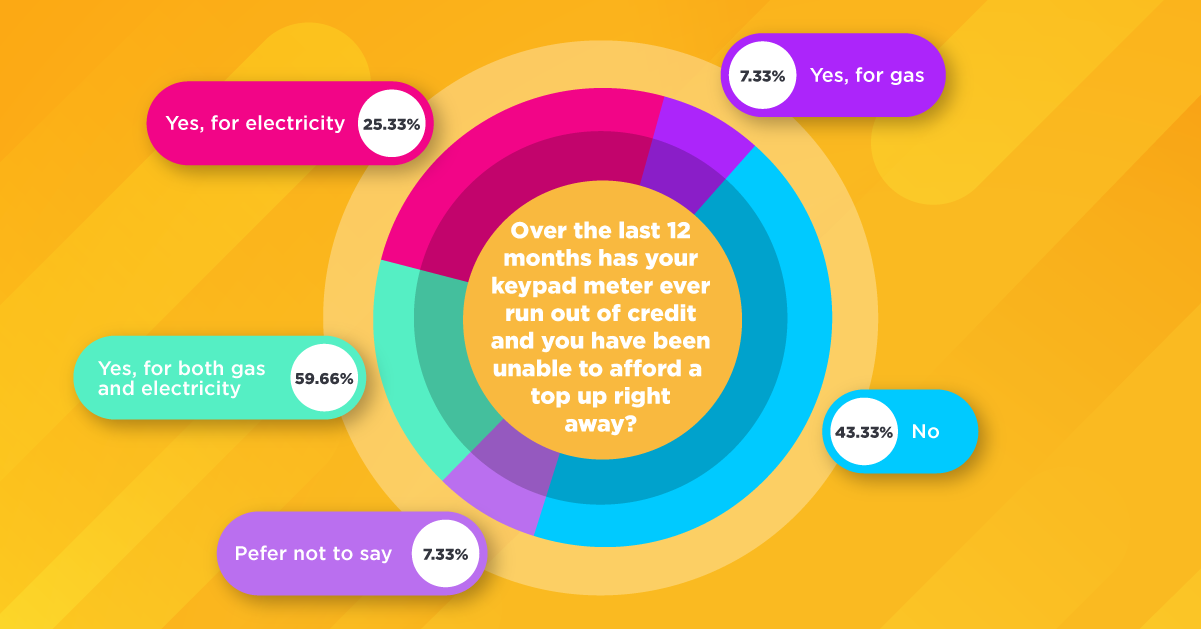

- There was a 12% decrease in the percentage of electricity keypad users who ran out of credit and couldn’t top up right away. For those who used a keypad for both electricity and gas, there was an 8% decrease.

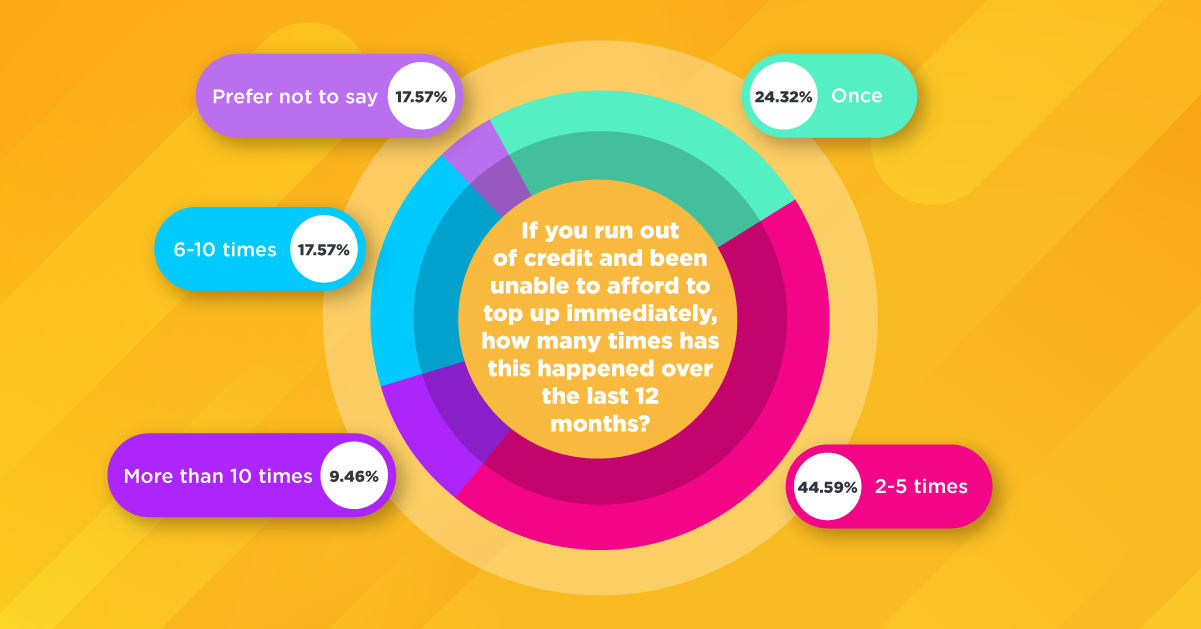

- 2-5 times is still the most common amount of times for those who did run out of credit, but the occurrence of “once” is up from 11.5% to 25% from 2022 to 2023—a small yet positive change.

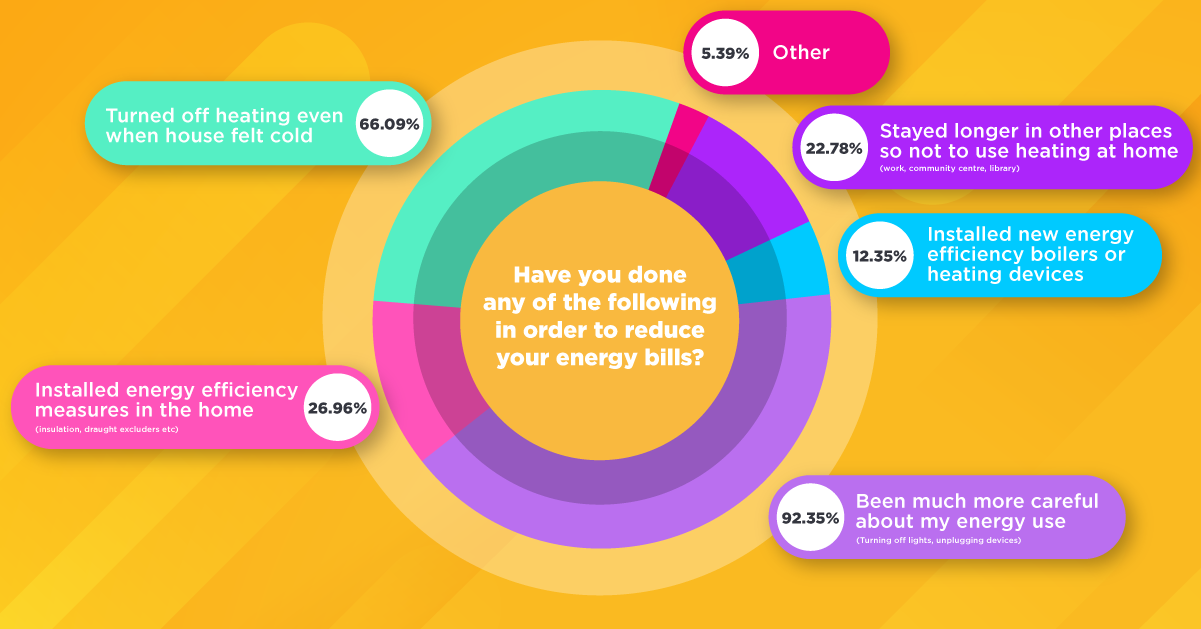

Most notably, the percentage of those who turned off the heating even when the house felt cold, has decreased by 17% from last year.

How effective has government support been?

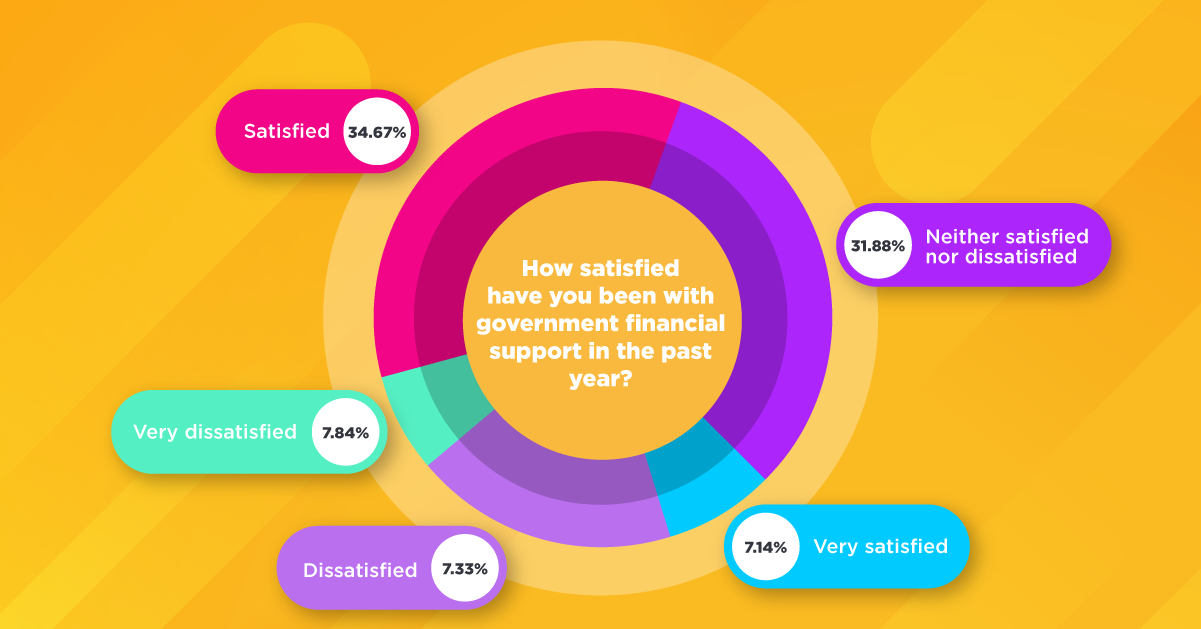

In response to these price increases, there have been various forms of financial support made available. When asked how satisfied respondents were with the support from the government in particular in addressing this price crisis the majority of people said they were “somewhat satisfied”.

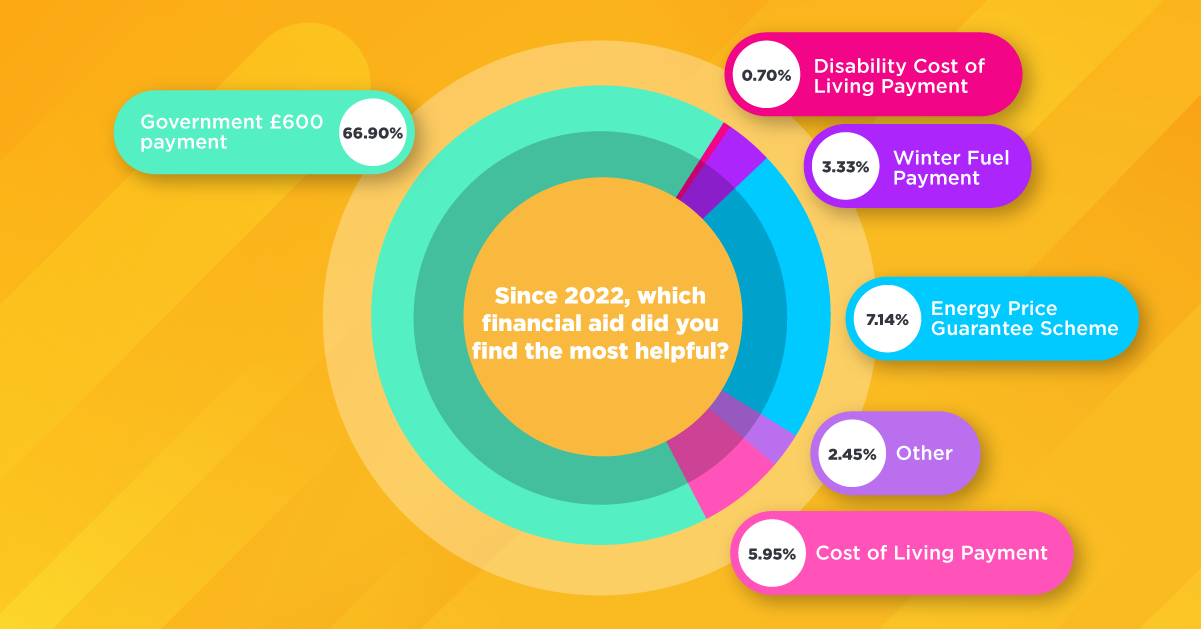

When asked which was the most helpful financial aid, 66% answered £600 Gov Pay Out, 20% answered Energy Price Guarantee, and 6% answered Cost of Living Payment.

Comments from Power to Switch

Power to Switch’s director Aodhan O’Donnell commented, “While the percentage of our respondents who have gone without heating their homes even when cold has decreased by almost a fifth, there is still 66% of them who do go without.

“We have also learned that 22% of these people stay in public places to avoid going home, and 27% have invested in energy efficiency features for the home. These are not signs that all is well in the energy market in Northern Ireland, and people should know where to find help when they need it.

“Contact your energy supplier if you are struggling, and be aware of various grants and schemes available to help cut down costs or simply help financially.”

What can you do?

The current energy crisis is rightfully worrying, but we would encourage you to take control where you can. Here are a few things you can do if you are already struggling:

1. Speak to your supplier

If you are finding your bills difficult to keep up with, you can contact your energy supplier directly to discuss a more affordable payment plan. This can help you to keep on top of your budgeting from month to month, and prevent difficult decisions between heating, petrol and grocery spending.

Simply, contact your supplier and tell them that you want to pay off your debts in instalments in a payment plan instead. If you come to an agreement, you will simply pay fixed amounts over a period of time. Your supplier must take into account both how much you can afford to pay and how much energy you’ll use in the future.

2. Contact support agencies

Where you need extra support, you can contact support agencies like Advice NI and Step Change.

- Advice NI

Advice NI offers advice on a range of topics and issues, including debt and benefits. They also have a fuel poverty support guide, which contains information about payments, available grants, and support.

Freephone helpline: 0800 915 4604

Website: https://www.adviceni.net/

- Step Change

Step Change Debt Charity offers free and impartial advice on debt and money management.

3. Cutting back on energy consumption

There are various ways of cutting back on your energy usage, such as:

- Turning off lights when you’re not using them

- Turning off appliances and devices at the plug, rather than leaving on standby

- Turning your thermostat down just 1 degree

- Drying clothes outside

4. Switch energy deals

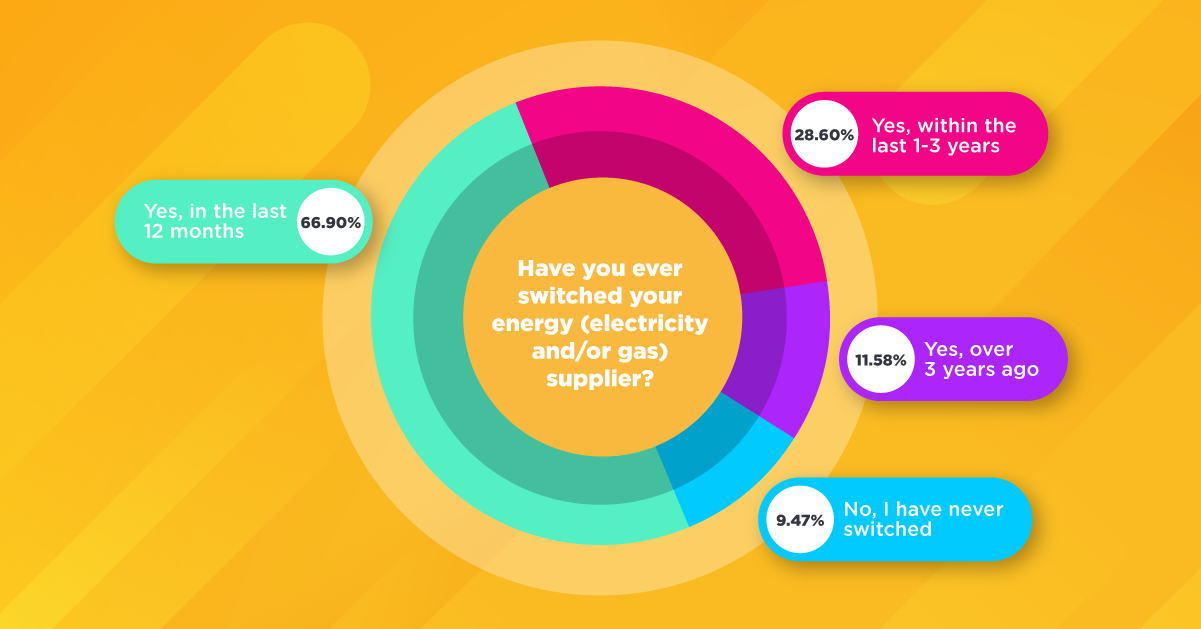

Another possible way to cut down your energy bills is to switch your energy deal. If you haven’t switched in the last 12 months, you are likely spending more than you ought to, and you can quickly find out whether there are better options for you. Using a tool like Power to Switch can help you find new, cheaper deals within minutes—completely risk and obligation free.

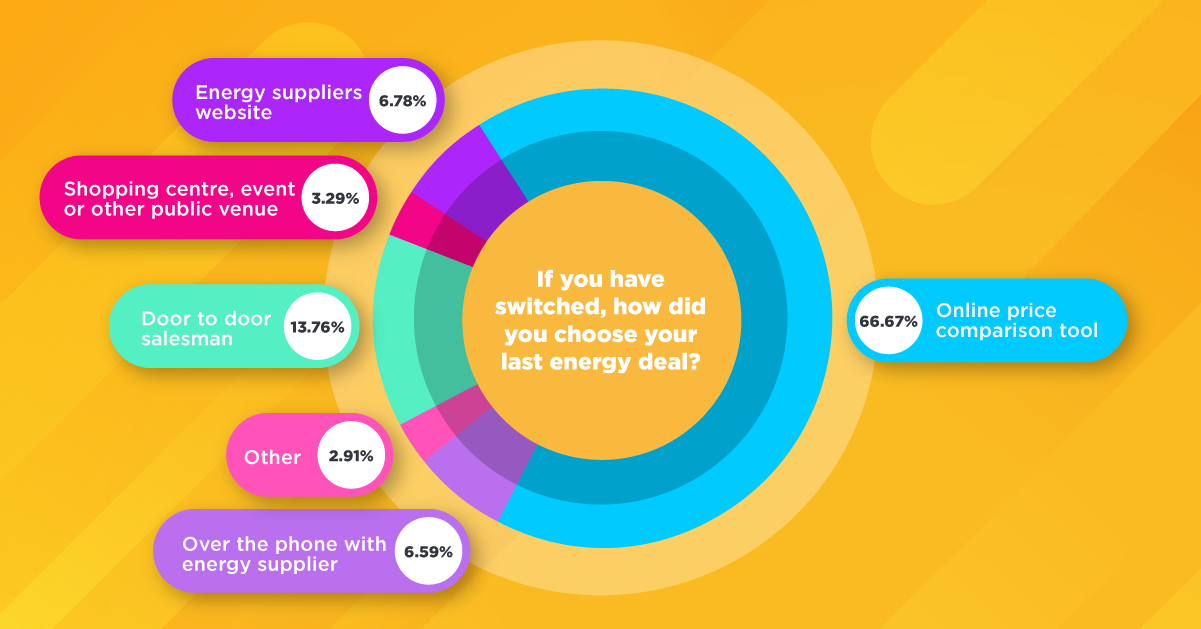

When our respondents switched, the vast majority used an online price comparison tool—like Power to Switch. The next most common method was via a door-to-door salesman, followed by directly through an energy suppliers website.

Of course, the drawback to these other options is that you can’t be sure that you have the cheapest tariff or deal across all suppliers quite as quickly or easily as when you compare with Power to Switch.

See if you can save money today by comparing your energy deals in just a few minutes.