Thanks to all of you, we have recently completed our annual Home Energy Survey! Over 800 of you got in touch to let us know your thoughts and experiences when it comes to your home energy—and it has painted a worrying picture of the energy crisis in Northern Ireland.

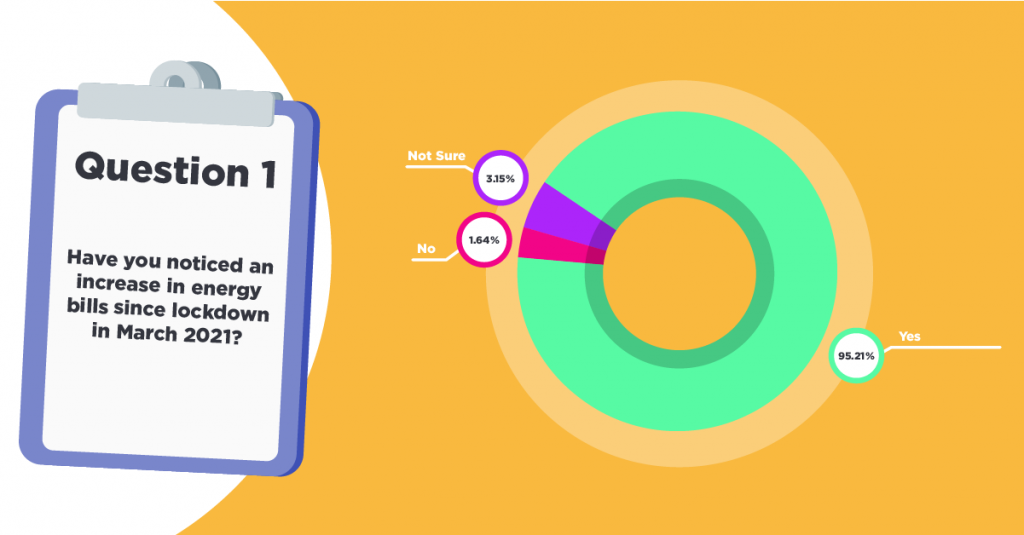

Not surprisingly, nearly everyone has noticed an increase in their energy bills since March 2021 (96%). The amount bills have increased since this time last year has also been significant.

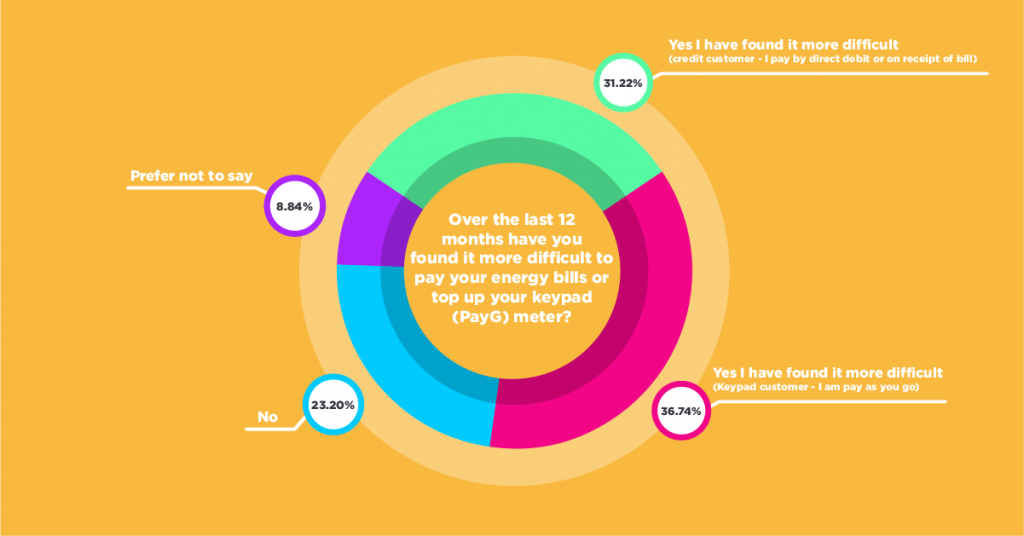

Across all respondents the average increase reported since last year was £408 – but some reported increases of up to £1500. This obviously puts considerable strain on households, limiting or doing away with disposable income altogether, with the majority of our respondents stating that they had found it more difficult to pay their energy bills over the last year.

Bill Pay and Pay as You Go customers have felt it equally difficult to keep up with energy payments which demonstrates how price hikes have affected all energy customers, no matter how they choose to pay.

People were concerned about a range of different issues, depending on their individual circumstances. We received comments such as:

- “My biggest concern would be not being able to keep my four young children warm and not being able to wash or dry their clothes.”

- “Not being able to keep a warm home for my children. I get my 5 kids on weekends which is the only time I put the gas heating on.“

- “That I can’t afford to keep my house running. That I have to stay in one room of the house in order to save money.”

- “Running out of oil and electricity and not being able to pay for either.”

We looked at whether people had struggled to keep up with their energy bills and found that almost 7 in 10 customers had found it more difficult to pay their bills. When we look at how customers pay for their energy around 37% of Pay as You Go customers struggled to keep up with bills whilst around 31% of bill pay customers had struggled to keep up with their energy bills.

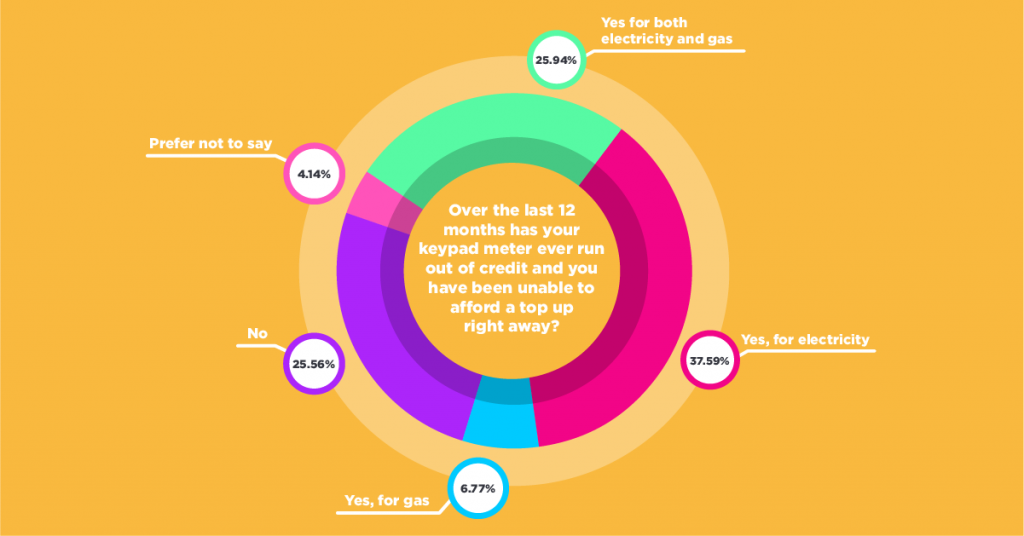

Unlike other energy markets Northern Ireland has a significant proportion of customer who choose Pay as You Go. A ‘Pay As You Go’ or prepayment meter simply means that you pay for energy before using it – around 45% of electricity customers and 70% of gas customers choose this method to pay for their energy. Many people like the convenience of paying in advance for their energy and not receiving a bill and often it can help them track their usage and consumption, but there is the risk of running out of credit (and ‘friendly credit’) and not being able to afford a top-up immediately.

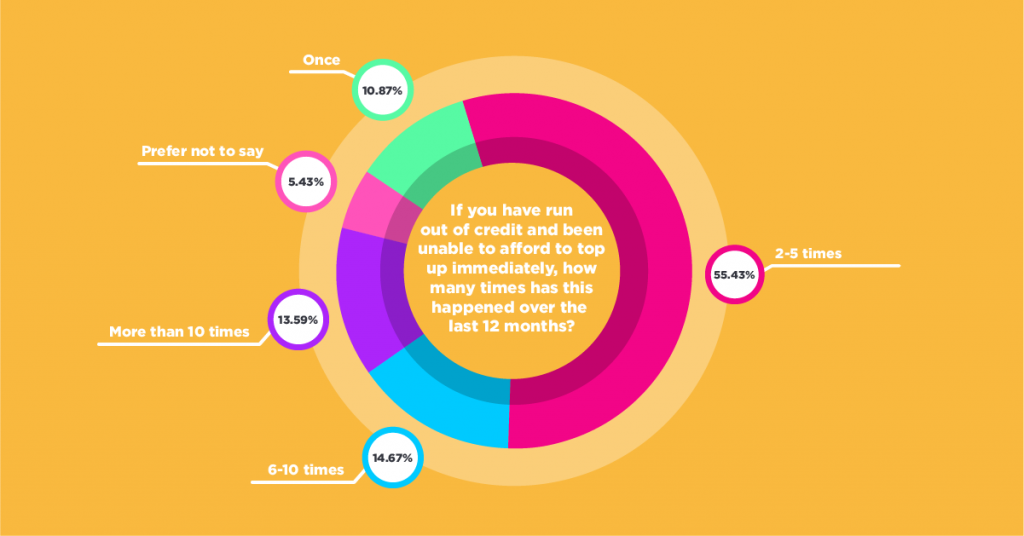

With increasing energy prices and the high number of Pay as You Go energy customers we wanted to understand whether people ran out of energy and were unable to ‘top-up’ immediately…a situation often referred to as ‘self disconnection’. Worryingly, around 70% of Pay as You go customer reported that this had happened to them. And in addition for most people this was not a one off or isolated incident. Most respondents (55%) reported that they had run out of credit and not been able to top-up on up to 5 different occasions in the last year, and 15% said this had happened 6-10 times in the last year. A worrying 14% of respondents had said that this happened to them over 10 times in the last year.

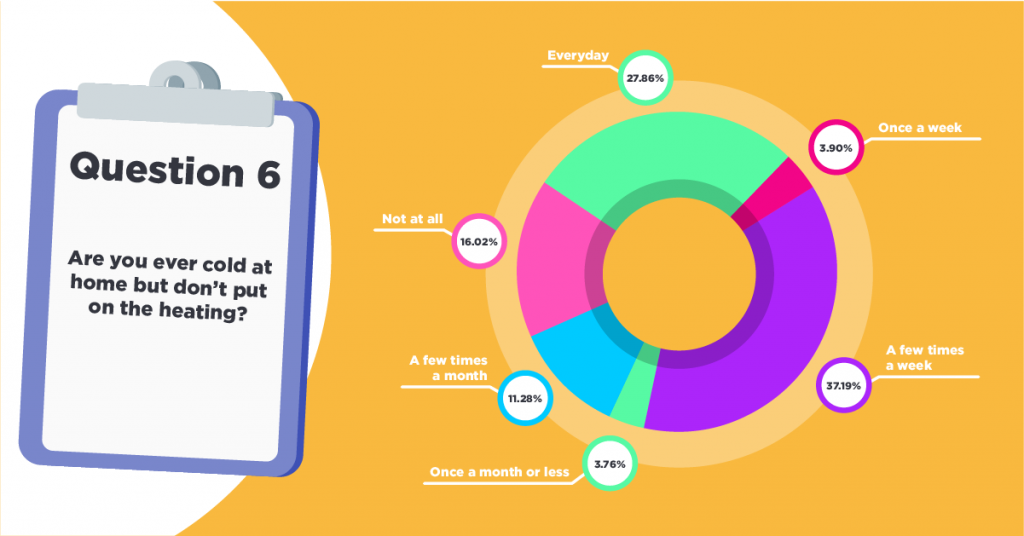

Perhaps most worrying was that almost a third of respondents said that when they were cold they refused to put on the heating in concern about their bills. Around 37% of respondents reported that when it was cold they would go without their heating a few times a week, and only 16% admitted that they never had to go without putting on the heating when they were cold. Many of our respondents told us that they were having to choose between their heat and their groceries:

- “My electric has increased by 100%.. paying double what I used to. My oil cost me £100 more for £100 less. I’m now at a point where I have to chose do I keep my family warm or do I feed them, and do I need to have manual electric blackouts so we can cook or watch TV?”

- “I’ve reduced to 3 hours a day of gas heating in my home I also go to bed early to save on electricity if this continues I seriously do not know what way I am suppose to live except in poverty.”

- “I live on my own and do not have the support from anyone else financially. It’s a choice of do I eat or go to bed cold tonight.”

- “It would leave me with no money to feed my family as I don’t have any extra money at all… the increase in energy bills means I have to get the money from somewhere else so it has to come out of my shopping bill.”

- “We cannot afford this increase so any further increase would mean turning off heat totally and cooking one meal per day. Previously we could buy cheaper cuts of meat, but they take longer to cook using electricity. The next step would be cutting meat out of our diet totally.”

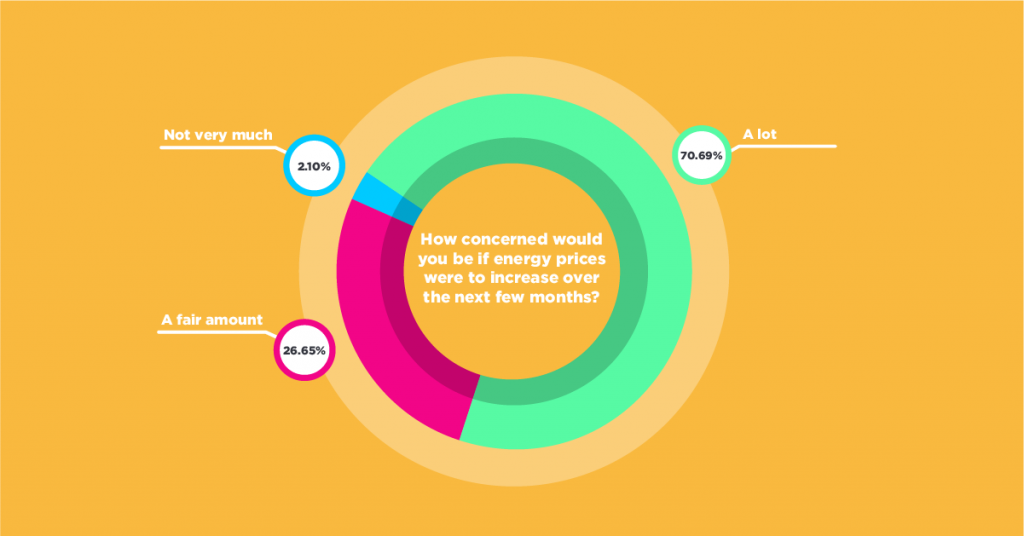

Undoubtedly, people have already been concerned about increases in their bills – but how would they feel about additional price hikes? For the vast majority of respondents, this was a very worrying thought, with over 70% answering “a lot” when questioned about how concerned they would be – which is up from 35% when we asked the same question this time last year. Only 2% of our respondents weren’t worried.

Some of our respondents told us what they would do if prices went up again:

- “As an old age pensioner I will probably stay in bed for longer periods of time.”

- “I would have to turn heating off in winter when I need it most. I am due to retire soon and it looks like I will have to stay at work to pay for my heating bills. I may never be able to retire.”

- “I wouldn’t be able to afford gas and electric and with 2 children in the house and a baby on the way I am already struggling!”

- “I am due to retire soon and it looks like I will have to stay at work to pay for my heating bills. I may never be able to retire.”

For other respondents with disabilities and health issues, the worries are even more complicated. They told us:

- “I am disabled. My son aged 6 is disabled, we rely on heat and warm water to avoid illness and manage our health problems.”

- “I’m disabled so I am at home 24/7 . I believe the hike in prices will significantly impact my health.”

- “Due to disability our heating has to be on all the time. Further increases will affect our quality of life in a detrimental way.”

- “The heating wouldn’t go on so we have a cold house, cold water and as an asthmatic I would get sick.”

- “I’ve suffered mental health issues and they would really be affected.”

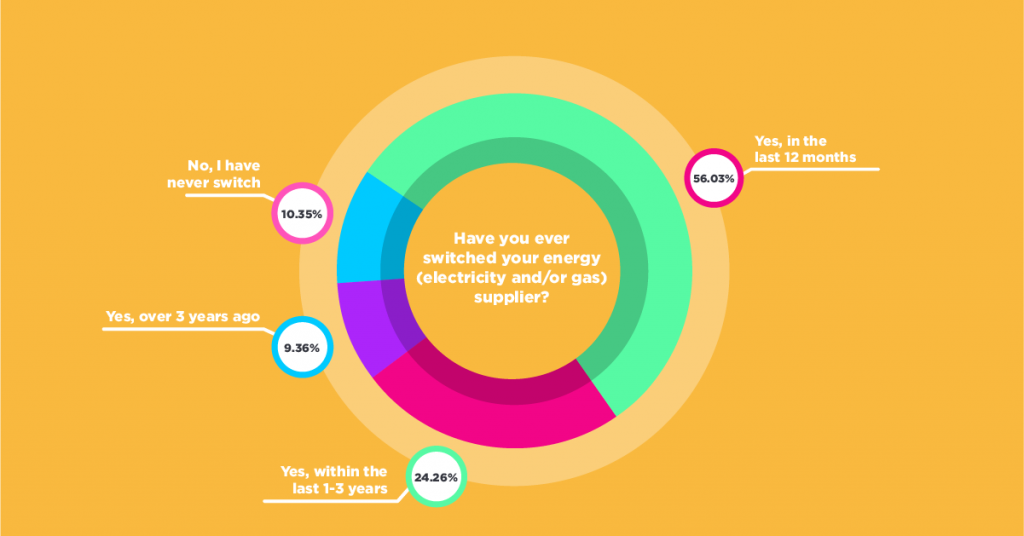

Of course, when it comes to saving on our energy bills, we at Power to Switch would always recommend you compare your energy deal, and consider switching to a cheaper option. If you haven’t switched in the last 12 months that typically means you are most likely to find a saving when you compare energy deals. Many of our respondents had switched (in fact, there were 10% more than last year!) but there were still 9% of people who had switched over 3 years ago, and 10% who had never switched at all.

The increase in those switching in the last 12 months undoubtedly has to do with the rising bills. One respondent told us, “The price of heating oil has more than doubled in the past few weeks. I have switched electricity supplier 3 times in the last year to try and keep spending down but I am very aware that electricity bills will soar in the next few months or so.”

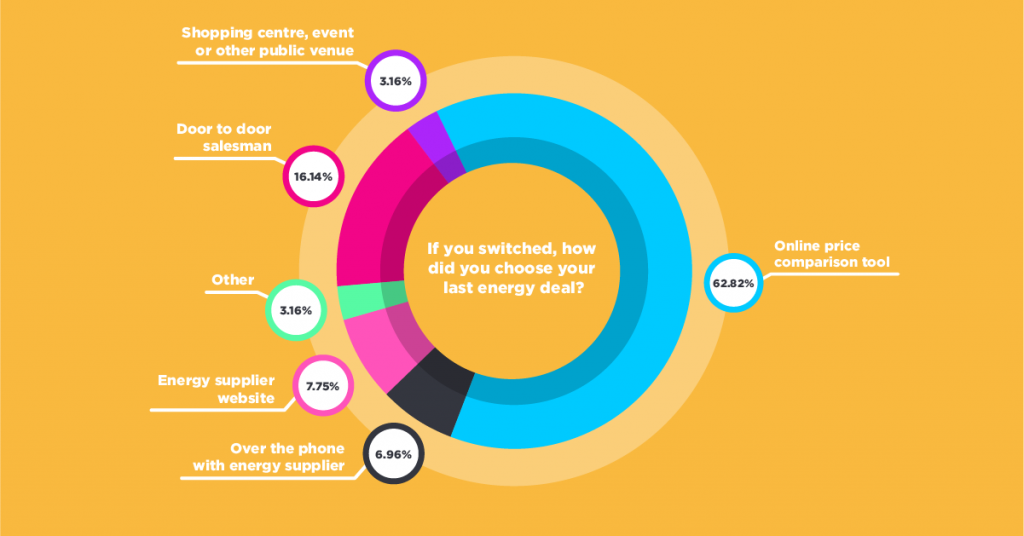

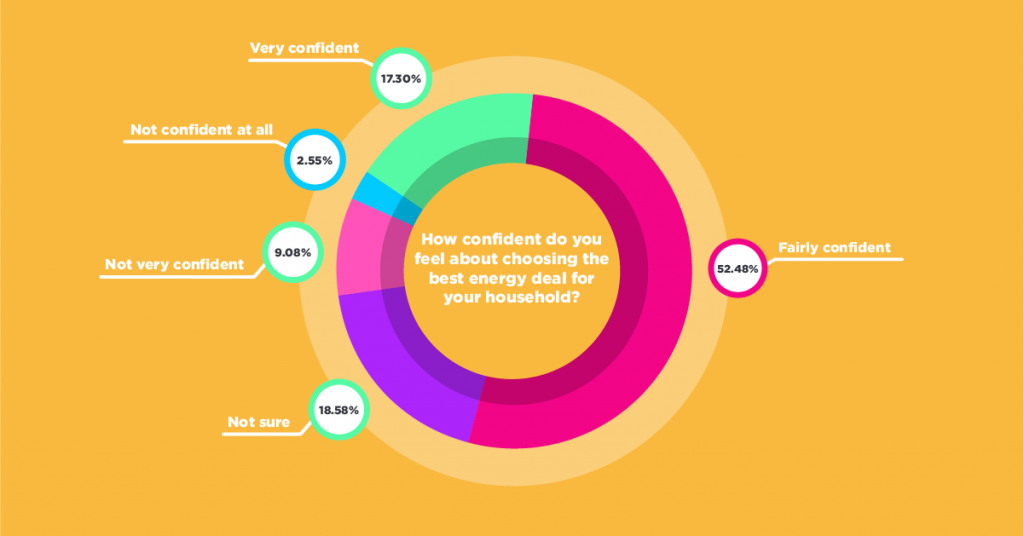

When asked about how and where our respondents switched energy deals, the majority switched with a comparison tool – like Power to Switch! Others switched with the help of a door-to-door salesman, and directly via an energy supplier’s website. Most of our respondents felt confident in how to switch.

If you’re part of the 30% who weren’t very confident or unsure about switching their energy deal, you can have a look at this blog from Power to Switch which goes into detail about the steps to switching.

What can you do?

The current energy crisis is rightfully worrying, but we would encourage you to take control where you can. Here are a few things you can do if you are already struggling:

1. Get all the support you’re entitled to

There are current 2 grants available for people in NI:

- Emergency Winter Support Scheme

The emergency scheme, developed by the Department for Communities alongside the Consumer Council, Bryson Energy and local energy suppliers, offers a one-off support of £100 to be spent on oil, gas or electricity (deadline 31st March).

More info: https://powertoswitch.co.uk/emergency-winter-scheme-launched-with-100-for-struggling-households/

- £200 support from Stormont

You are automatically eligible if you if you are a resident of Northern Ireland and you received one of the following benefits between Monday 13th December and Sunday 19th December 2021: - Pension Credit

- Universal Credit

- Income-related Employment and Support Allowance

- Income-based Jobseekers Allowance

- Income support

More info: https://powertoswitch.co.uk/stormont-approves-new-200-support-payment/

2. Speak to your supplier

If you are finding your bills difficult to keep up with, you can contact your energy supplier directly to discuss a more affordable payment plan. This can help you to keep on top of your budgeting from month to month, and prevent difficult decisions between heating, petrol and grocery spending.

Simply, contact your supplier and tell them that you want to pay off your debts in instalments in a payment plan instead. If you come to an agreement, you will simply pay fixed amounts over a period of time. Your supplier must take into account both how much you can afford to pay and how much energy you’ll use in the future.

3. Contact support agencies

Where you need extra support, you can contact support agencies like Advice NI and Step Change.

- Advice NI

Advice NI offers advice on a range of topics and issues, including debt and benefits. They also have a fuel poverty support guide, which contains information about payments, available grants, and support.

Freephone helpline: 0800 915 4604

Website: https://www.adviceni.net/

- Step Change

Step Change Debt Charity offers free and impartial advice on debt and money management.

4. Other actions you can take

There are various ways of cutting back on your energy usage, such as:

- Turning off lights when you’re not using them

- Turning off appliances and devices at the plug, rather than leaving on standby

- Turning your thermostat down just 1 degree

- Drying clothes outside

Another possible way to cut down your energy bills is to switch your energy deal. If you haven’t switched in the last 12 months, you are likely spending more than you ought to, and you can quickly find out whether there are better options for you. Using a tool like Power to Switch can help you find new, cheaper deals within minutes—completely risk and obligation free.